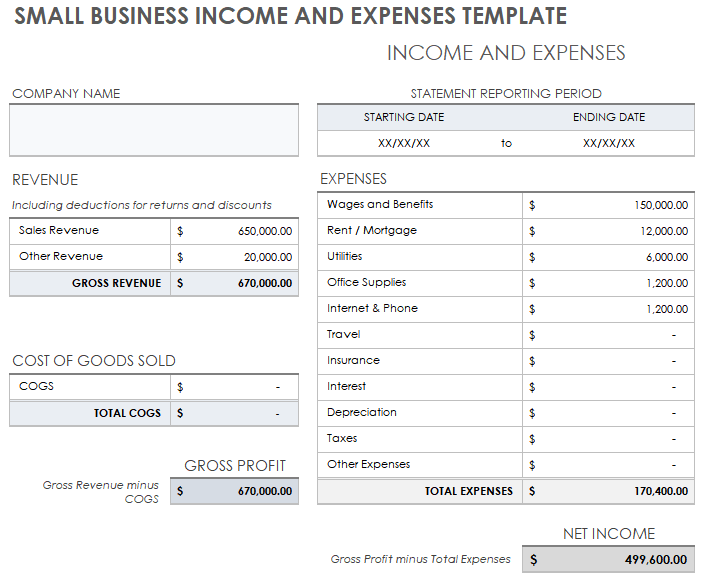

Printable Small Business Income and Expenses Template

Download Printable Small Business Income and Expenses Template

Microsoft Excel

|

Microsoft Word

|

Adobe PDF

| Google Sheets

Use this printable small business income and expenses template to determine your net income over a period of time. Enter values into the customizable line-item rows, and the template will calculate your revenue and cost of goods sold (COGS) to determine your gross profit. Enter your expenses (such as rent, utilities, and office supplies) to see your total net income. This template is a great tool to track your business's finances over time.

Read our article on free small business expense templates to find additional resources and to get the most out of your small business budgeting.

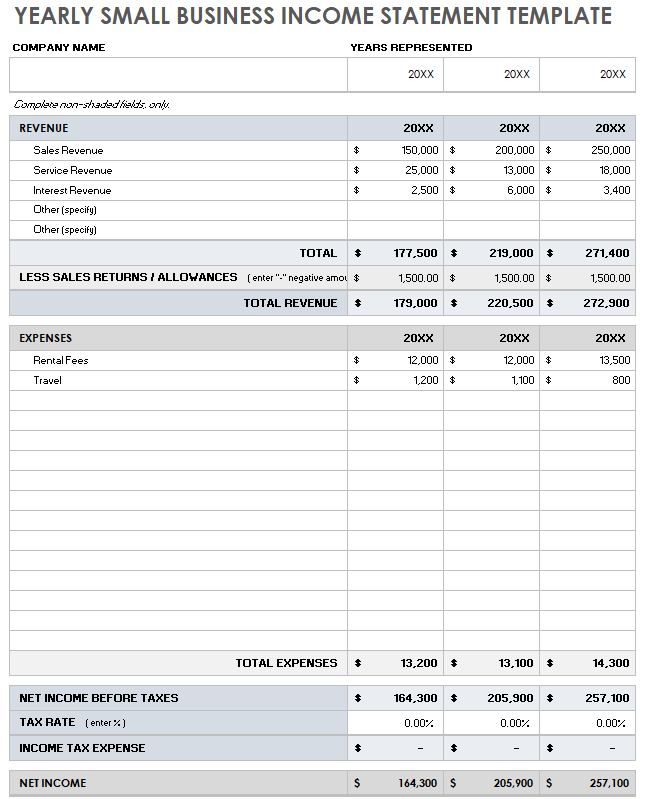

Yearly Small Business Income Statement Template

Download Yearly Small Business Income Statement Template

Microsoft Excel

| Google Sheets

Use this yearly small business income statement template to manage your profit and losses over a three-year timeline. Track your costs in the customizable Expenses column, and enter your revenue and expenses to determine your net income. The template also includes a built-in tax rate calculator for a more accurate account of your net profit.

To find more resources, check out our comprehensive roundup of free profit and loss templates.

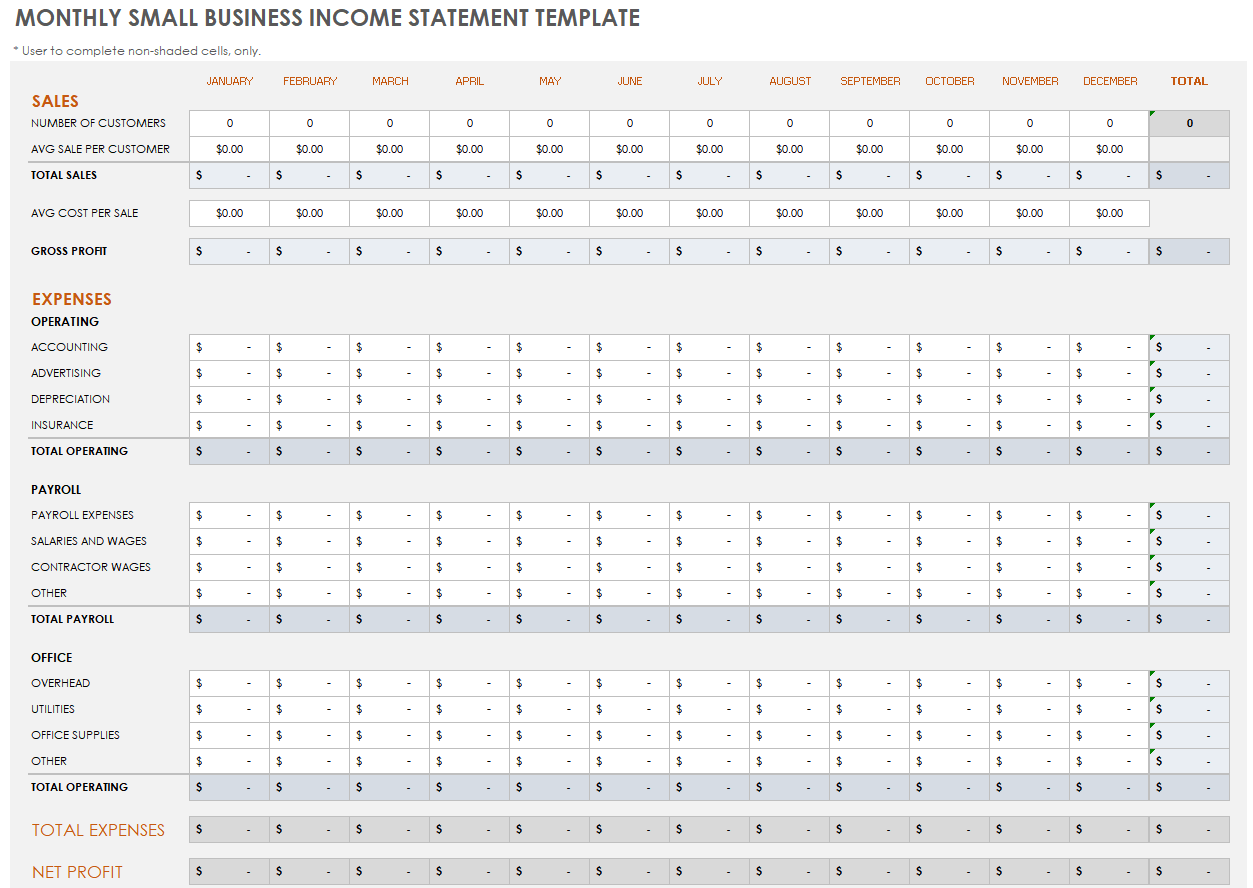

Monthly Small Business Income Statement Template

Download Monthly Small Business Income Statement Template

Microsoft Excel

| Google Sheets

Use this monthly small business income statement template to track and manage your small business finances. Enter the number of customers and the average sale per customer to determine your total monthly sales. Then, enter your operating, payroll, and office expenses to determine your total expenses. The template will automatically calculate these totals to show your net profit.

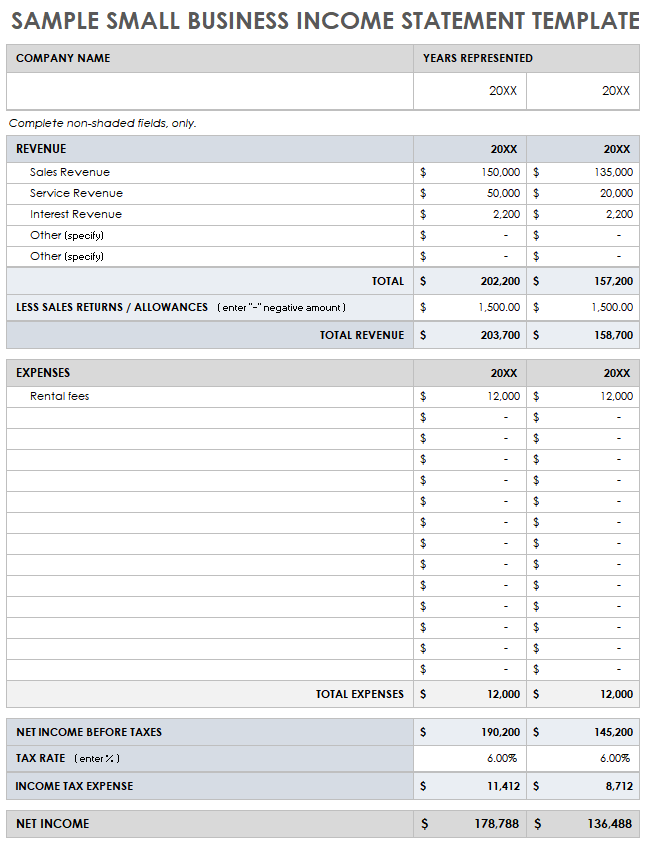

Sample Small Business Income Statement Template

Download Sample Small Business Income Statement Template

Microsoft Excel

| Google Sheets

Use this simple small business income statement template for an overall analysis of your net income. You can customize the Revenue and Expenses lines to include items specific to your business; additionally, the template includes a Years Represented column that allows you to compare numbers over a two-year timeline. This is the perfect tool for taking a quick snapshot of your business cash flow.

To find more resources, check out our small business budget templates.

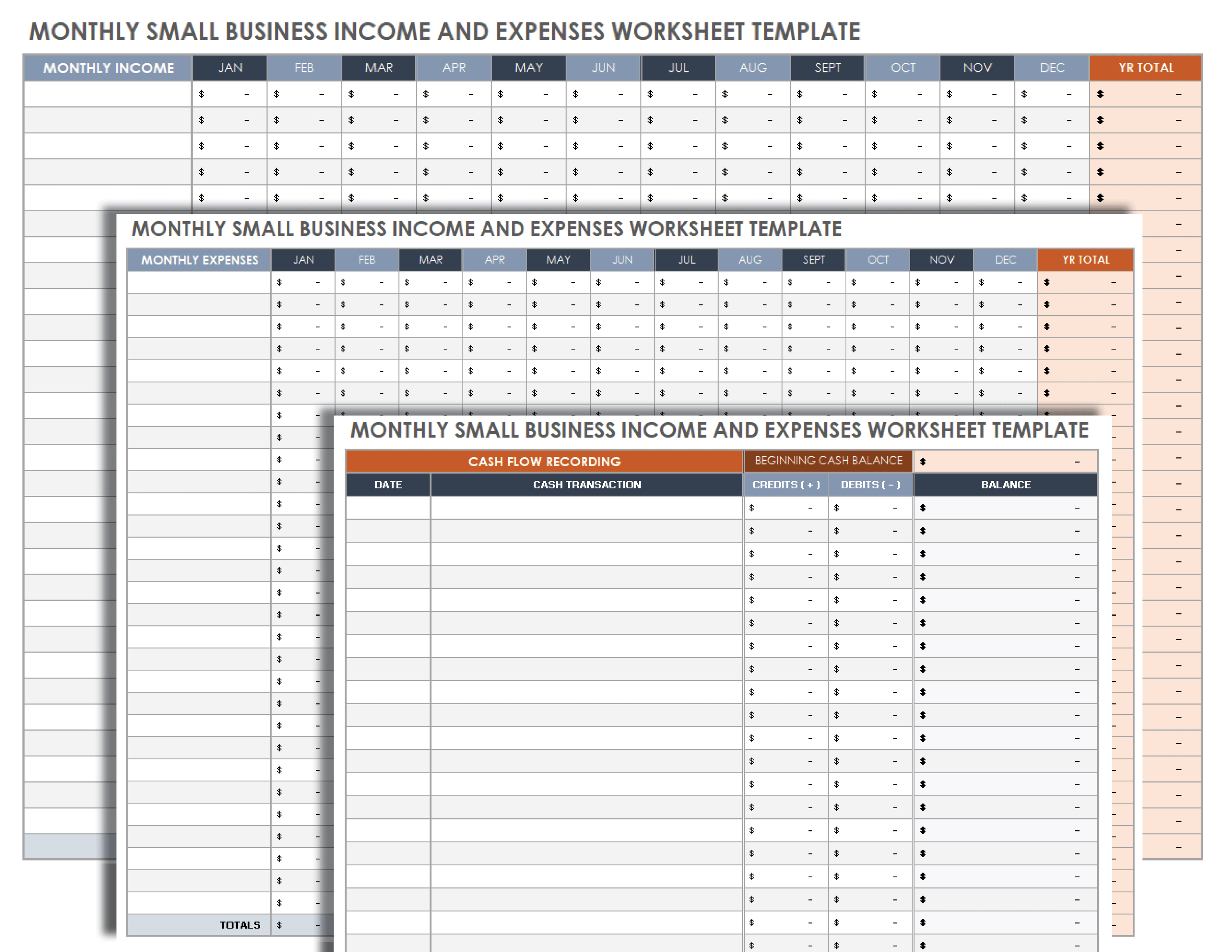

Printable Monthly Small Business Income and Expenses Worksheet Template

Download Printable Monthly Small Business Income and Expenses Worksheet Template

Microsoft Excel

|

Adobe PDF

| Google Sheets

This simple, printable template is the perfect tool for tracking your business’s income, expenses, and transactions. The template includes three separate worksheets — simply enter monthly financial data, and the template will automatically calculate yearly totals. Help ensure you meet your financial goals, accurately predict projections, and make necessary adjustments with this template.

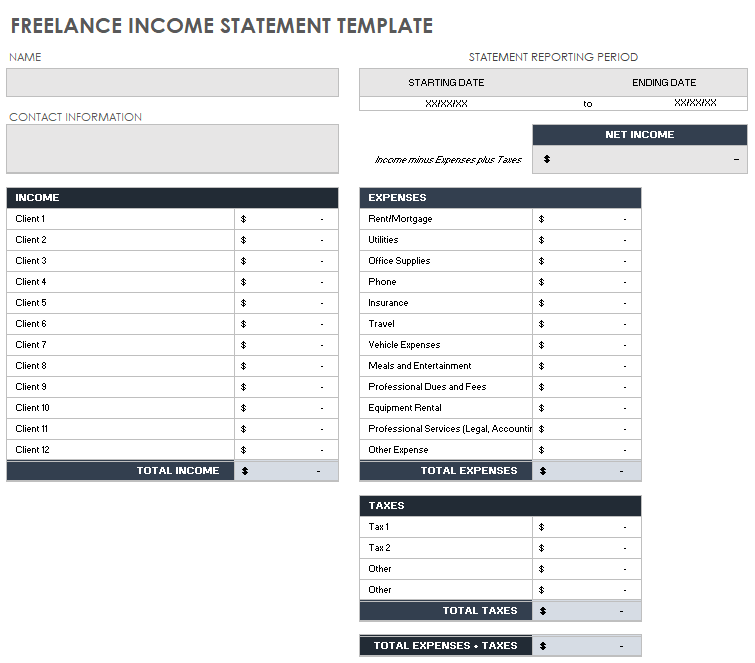

Freelance Income Statement Template

Download Freelance Income Statement Template

Microsoft Excel

| Google Sheets

Self-employed individuals can use this template to track their business income from clients, along with any business expenses. Enter your personalized expenses, including rent, office supplies, and insurance, to see your cash outflow. Then, enter your taxes, and the template will automatically calculate your net income. This is a must-have tool for small business owners looking to understand their business profits.

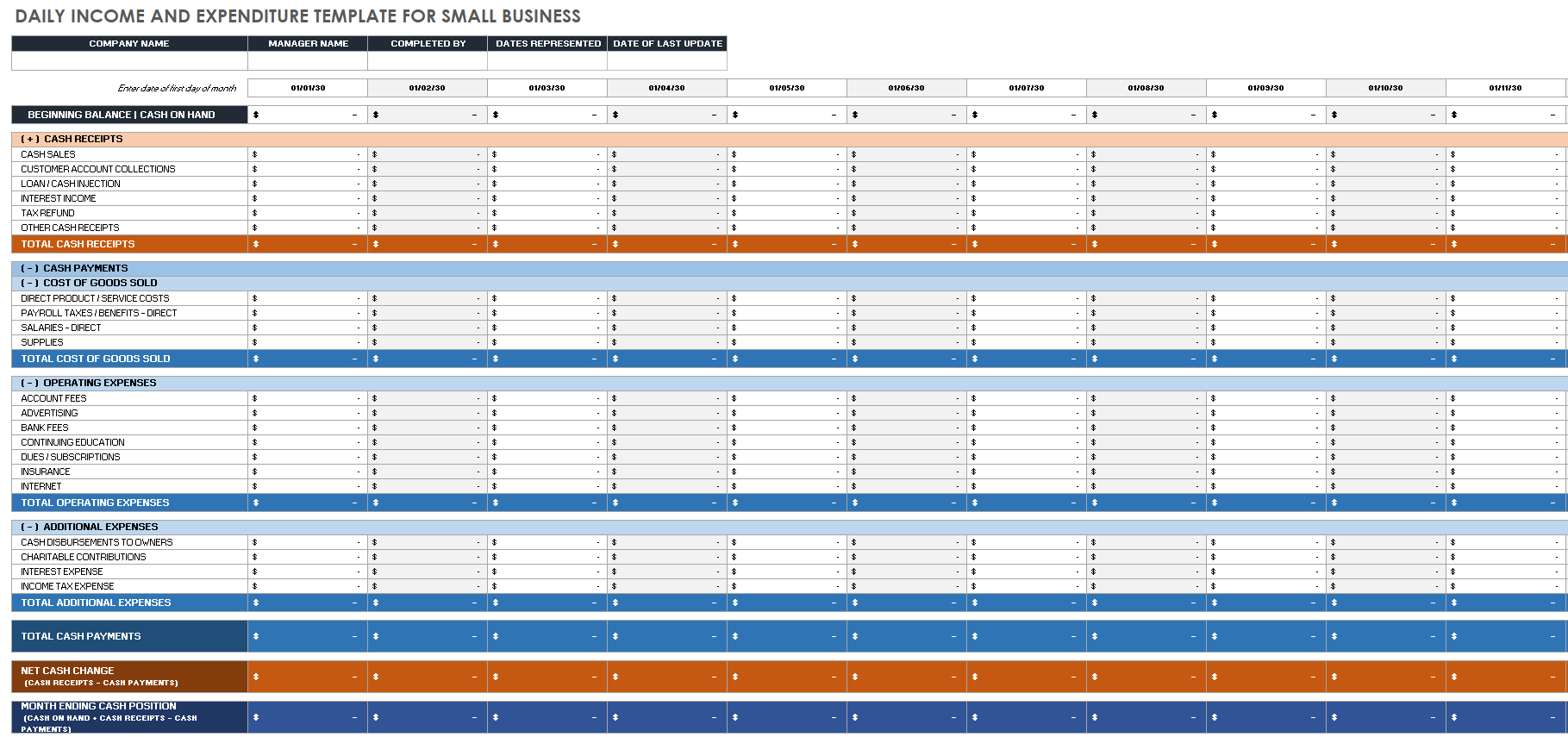

Daily Income and Expenditure Template for Small Business

Download Daily Income and Expenditure Template for Small Business

Microsoft Excel

| Google Sheets

For a daily analysis of your small business’s cash flow, use this template to track cash receipts, cash payments, and operating expenses. The template automatically calculates these totals on a daily basis to provide you with a detailed financial report. The template also shows your monthly ending cash position, so you can avoid any shortcomings.

Check out our profit and loss templates for more resources on tracking your business’s cash flow.

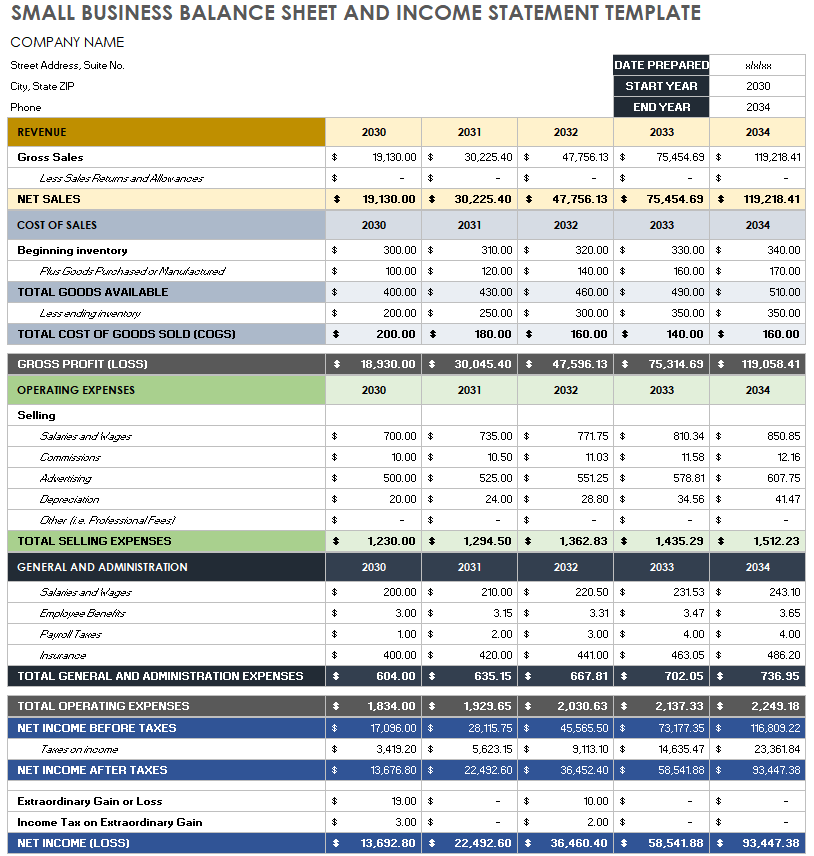

Small Business Balance Sheet and Income Statement Template

Download Small Business Balance Sheet and Income Statement Template

Microsoft Excel

| Google Sheets

Use this income and expenses spreadsheet to help ensure that you never lose sight of your small business’s financial outlook. Enter your revenue and expenses, and the template will automatically calculate your net income. Plus, the customizable year columns enable you to compare your net income over a five-year timeline so that you can easily forecast your business’s economic health.

Read our article on small business balance sheet templates for more resources on tracking your business expenses.

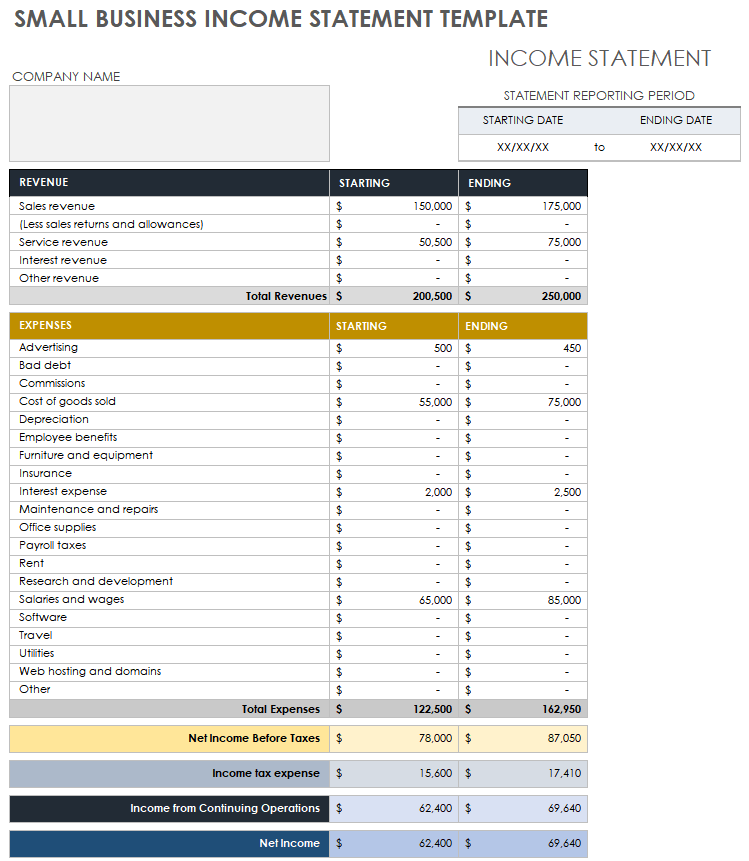

Small Business Income Statement Template

Download Small Business Income Statement Template

Microsoft Excel

| Google Sheets

This simple small business income statement template calculates your total revenue and expenses, including advising, equipment, and employee benefits, to determine your net income. Use this template to track and compare your finances over a two-year timeline. Save the document so that you always have quick insight into the financial status of your business.

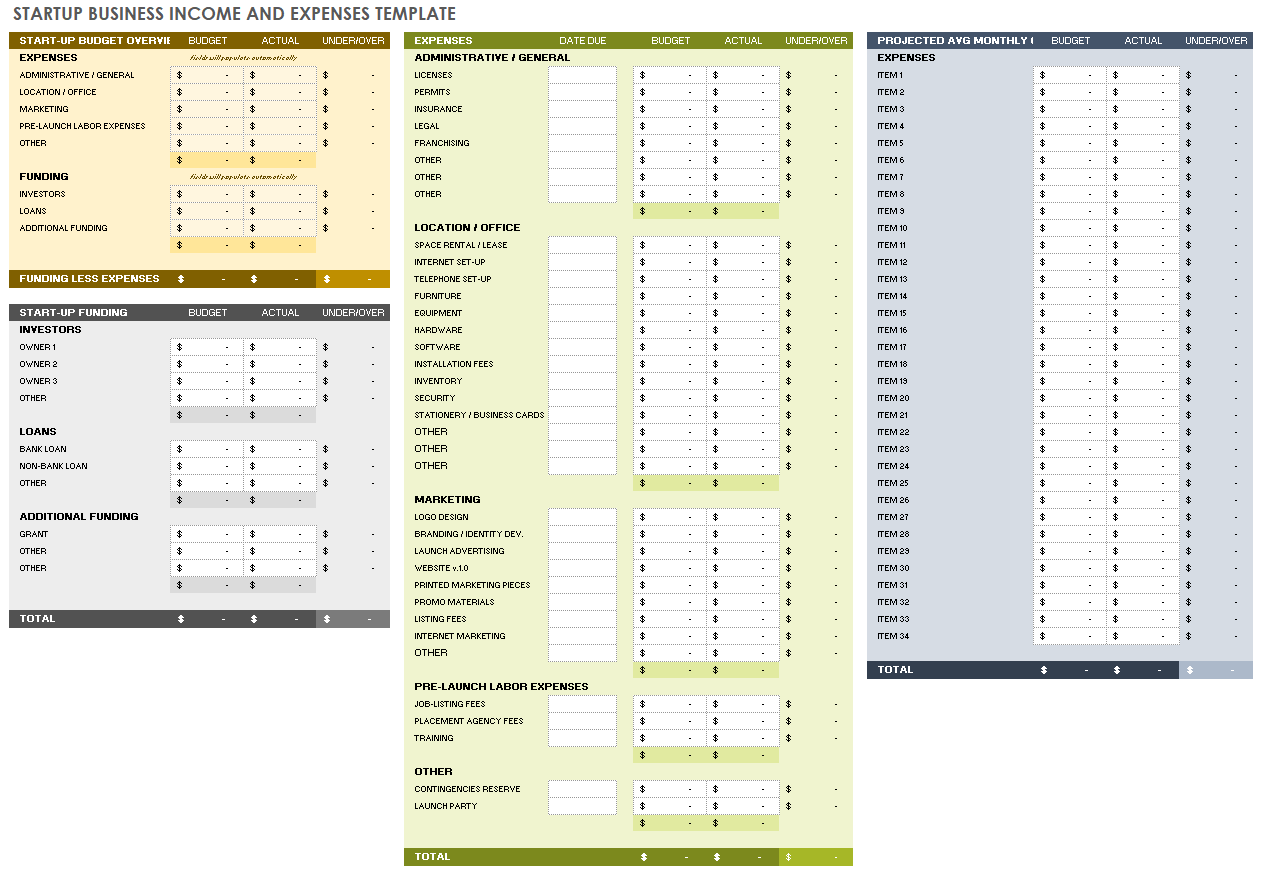

Startup Business Income and Expenses Template

Download Startup Business Income and Expenses Template

Microsoft Excel

|

Adobe PDF

| Google Sheets

Use this startup business income and expenses template to track your business’s cash flow. Compare your budgeted expenses and funding to your actual spending to understand any discrepancies. Overall, this template can help you make well-informed, financially accurate predictions so that you can reach your business goals.

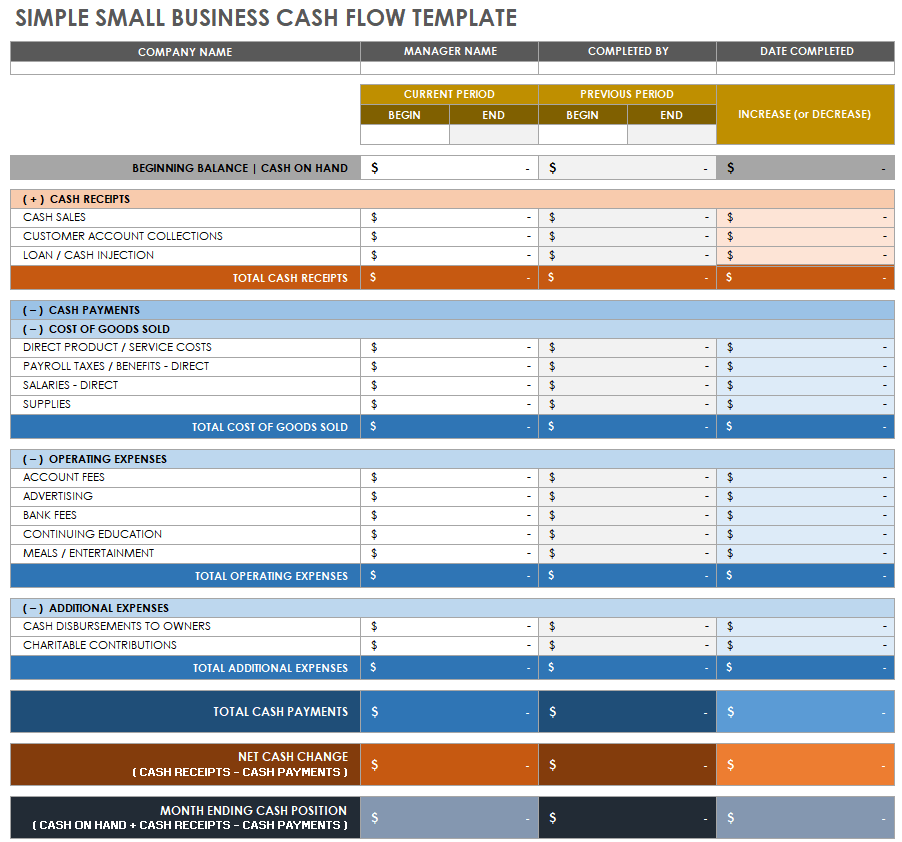

Simple Small Business Cash Flow Template

Download Simple Small Business Cash Flow Template

Microsoft Excel

| Google Sheets

Use this simple small business cash flow template to monitor your cash increase or decrease over a certain period of time. Enter your cash receipts, payments, COGS, and operating expenses, and the built-in formulas will calculate your total cash payments, net cash change, and month-ending cash position.

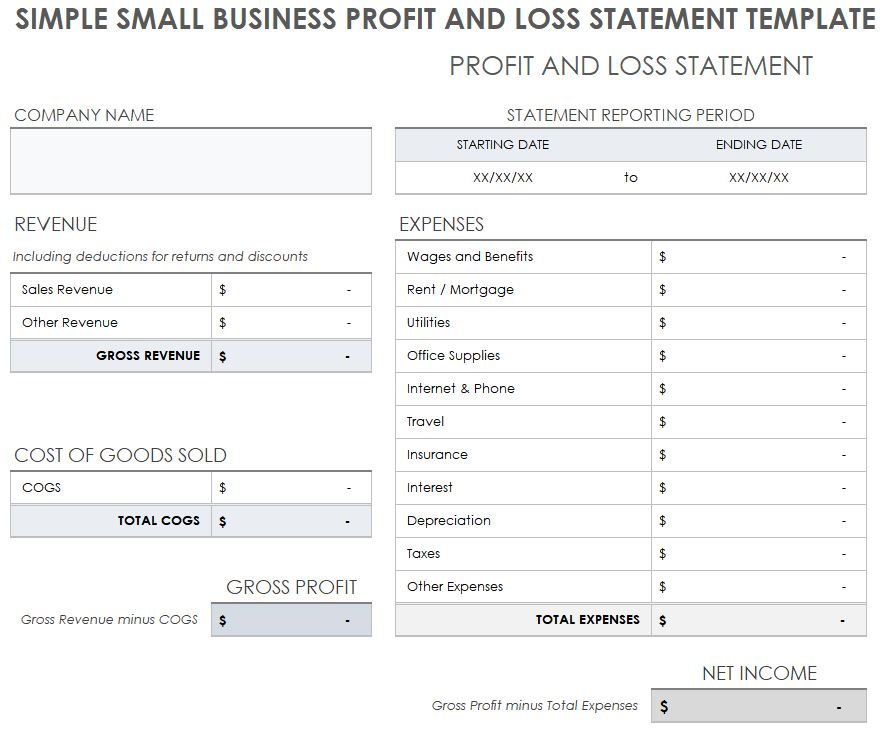

Simple Small Business Profit and Loss Template

Download Simple Small Business Profit and Loss Template

Microsoft Excel

| Google Sheets

Regardless of your industry, you can use this simple small business profit and loss template to analyze your business’s financial status over a specific period of time. Customize your expenses by adding or removing line items, and the built-in formulas will calculate your gross profit and net income.

Read our article on small business profit and loss templates to find additional resources and to get the most out of your small business’s profit and loss tracking.

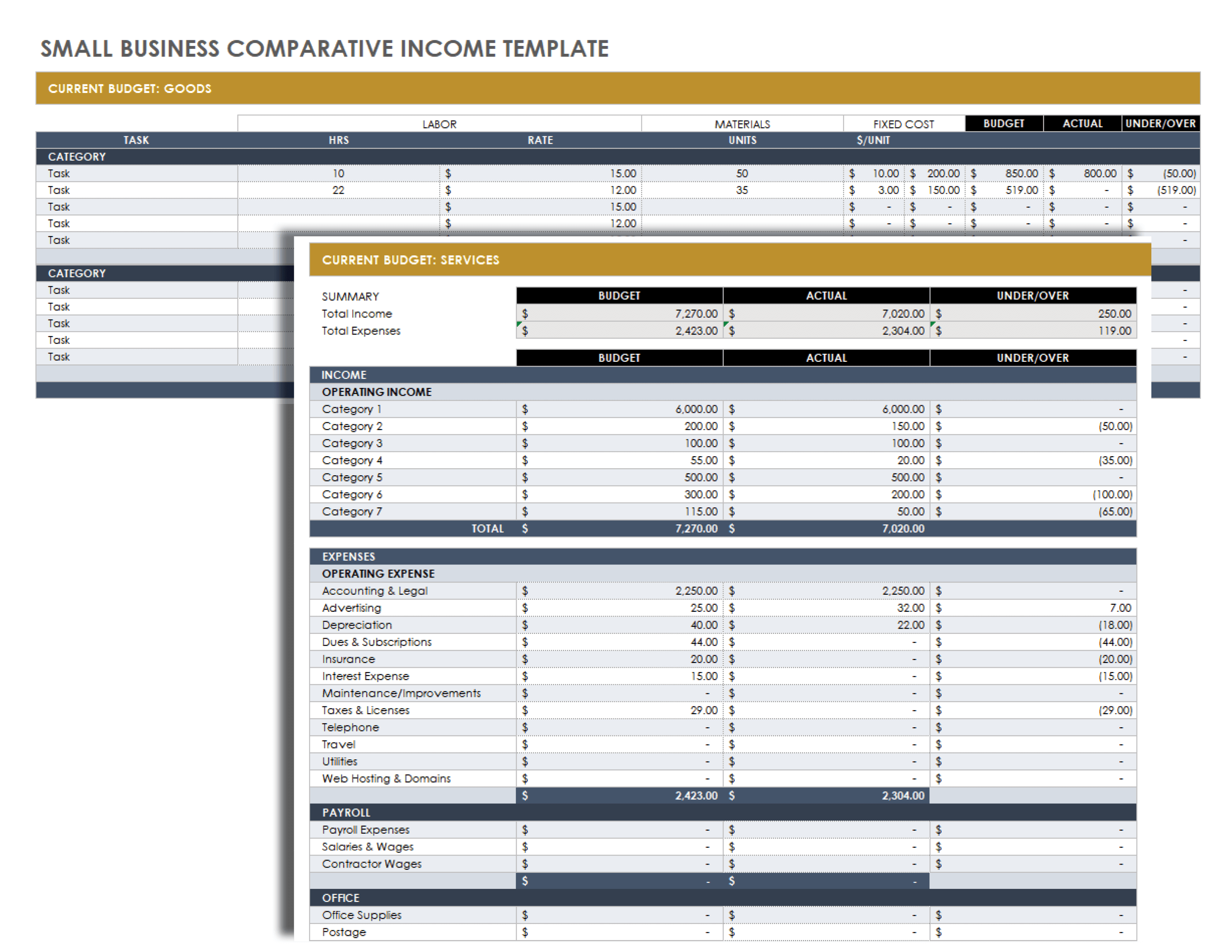

Small Business Comparative Income Template

Download Small Business Comparative Income Template

Microsoft Excel

| Google Sheets

Use this detailed small business comparative template to closely maintain watch over your financial position. Enter line items for income and expenses to compare your budget to actual calculations. With detailed use, this template will enable you to never lose sight of your business's cash flow.

What Is a Small Business Income Statement Template?

A small business income statement template is a financial statement used to report performance. Templates include calculations for revenue, expenses, and overall profit and loss, and they are used to document, analyze, and project business finances.

If you are a current or prospective small business owner, it’s imperative that you track your income and expenses, as doing so will ensure you have accurate information regarding how your company spends and makes money. An income statement template helps you to identify areas of risk and patterns in profit and loss, and to make educated decisions around your budget.

A small business income statement template typically includes the following line items for tracking your business's financial status:

- Budget: A budget is a spending plan for your business based on your estimated income and expenses.

- Cash Ending Position: This refers to the money your business has at any specific point in time.

- Cash Flow: This is the amount of money that moves in and out of your business.

- Cost of Goods Sold (COGS): This is any money spent that is associated with your product, such as packaging and labor.

- Expenses: List anything on which you spend money to run your business, such as rent, advertising, equipment, insurance, phone, and employee salaries.

- Gross Profit: Determine this number by subtracting the COGS from your total sales.

- Gross Revenue: The formula to calculate gross revenue is total revenue less the COGS.

- Income: List anything that brings money into your business, such as sales and donations.

- Net Income or Net Profit: This number reflects the amount earned from sales.

- Revenue: Calculate revenue by adding together the total amount of income made by sales and services.

- Tax: This includes any mandatory monetary contributions made to the government.

Manage Income Statements and Drive Success with Smartsheet for Small Businesses

Discover a better way to connect your people, processes, and tools with one simple, easy-to-use platform that empowers your team to get more done, faster.

With Smartsheet, you can align your team on strategic initiatives, improve collaboration efforts, and automate repetitive processes, giving you the ability to make better business decisions and boost effectiveness as you scale.

When you wear a lot of hats, you need a tool that empowers you to get more done in less time. Smartsheet helps you achieve that. Try free for 30 days, today.