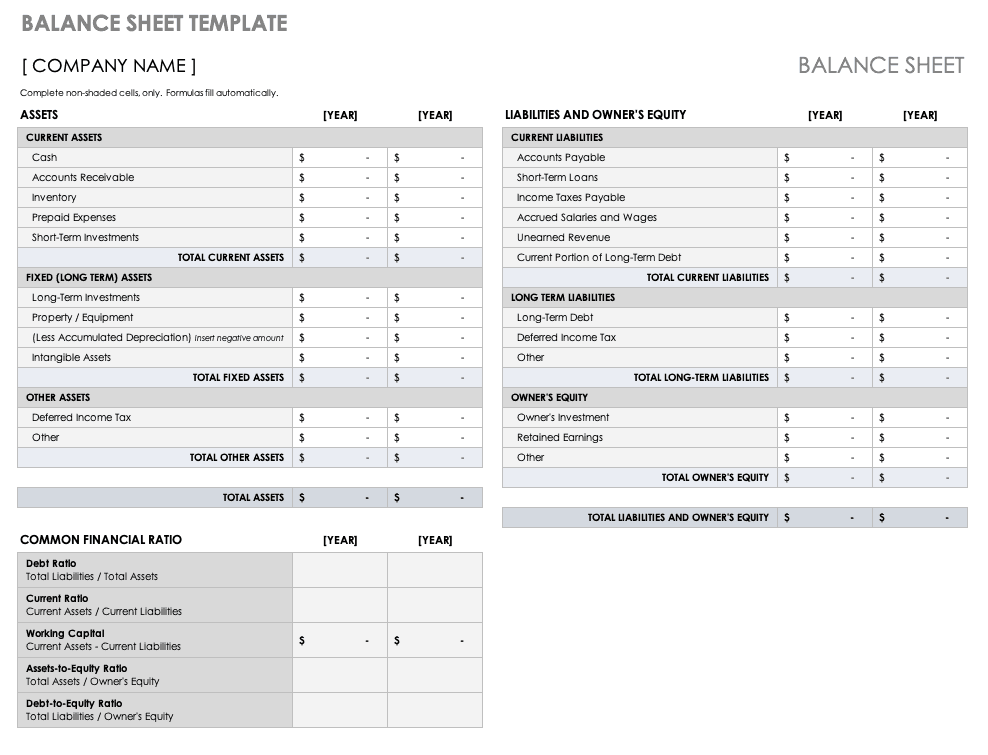

Balance Sheet Template

Calculate the balance of a company’s assets, liabilities, and equity to get a snapshot of its financial position at any given time. The template includes lines for assets such as cash, accounts receivable, inventory, and investments, along with liabilities, including accounts payable, loans, and payroll. Add your own line items to this Excel sheet, and the template will automatically calculate the totals.

Download Balance Sheet Template

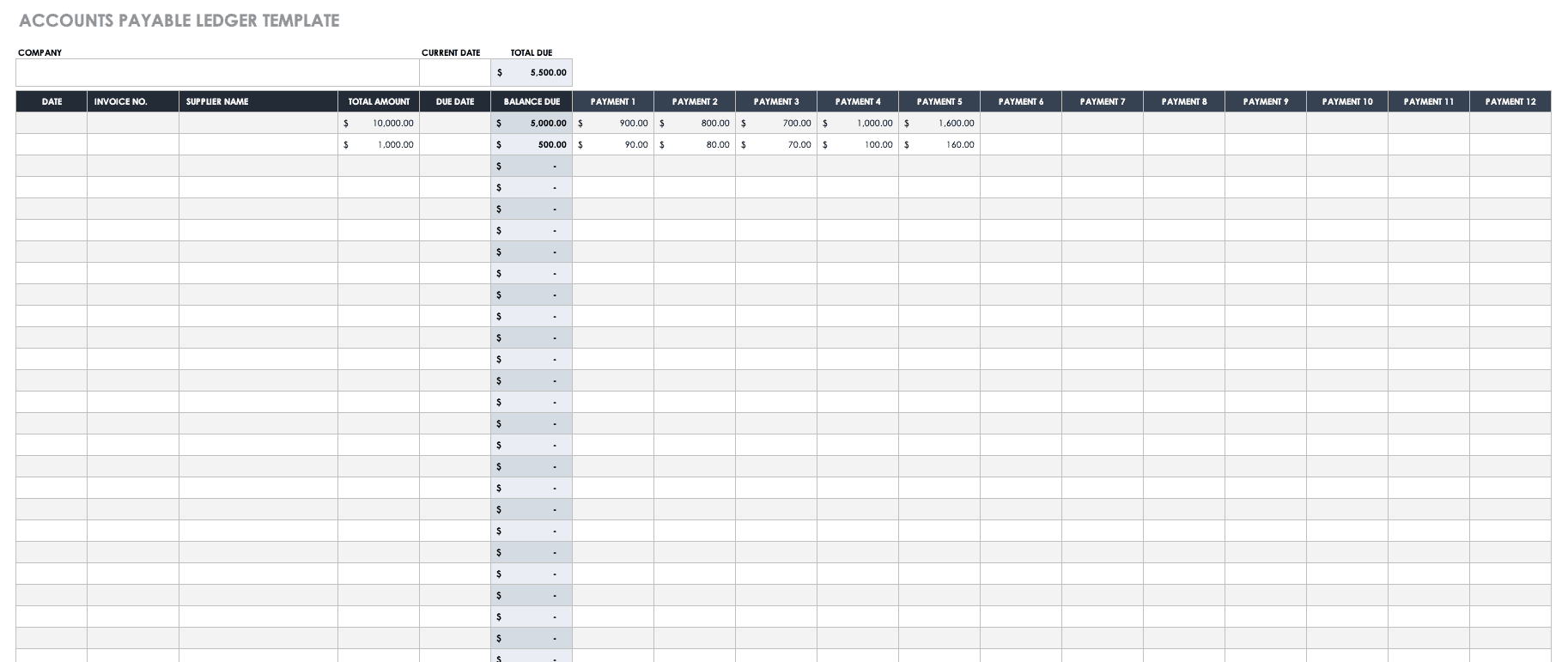

Accounts Payable Ledger

Use this template to track accounts payable transactions, including supplier names, invoice numbers, amounts due, and completed payments. This spreadsheet template makes it easy to organize important account information that can then be referenced for accounts payable reconciliation. Customize the template by adding or reducing columns to suit your business needs.

Download Accounts Payable Ledger

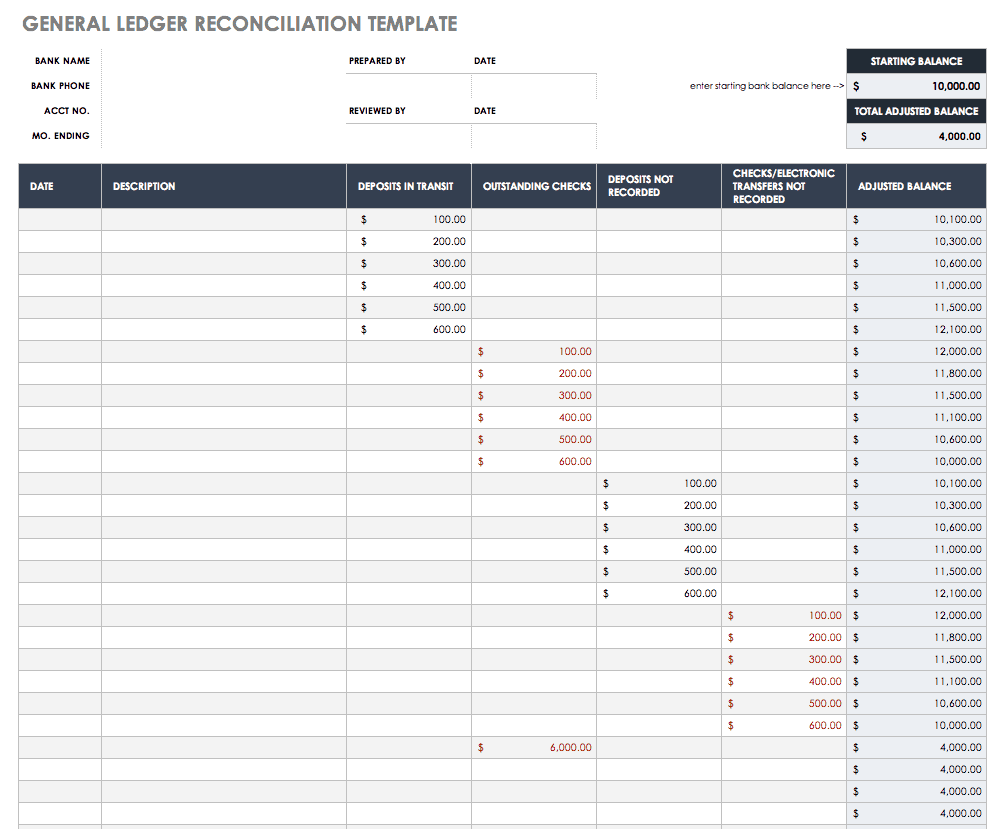

General Ledger (GL) Reconciliation Template

Companies or individuals can use this general ledger (GL) reconciliation template for bank reconciliation. Businesses can also use it for reconciling balance sheet accounts, such as accounts payable, by editing the template to show the appropriate account information. Enter the balance from your bank statement or subledger along with the general ledger balance, and adjust amounts based on outstanding deposits and checks. The template will then reflect any variance between the records. If they are not reconciled, you can examine the records for errors or other discrepancies that need to be resolved.

Download General Ledger (GL) Reconciliation Template — Excel

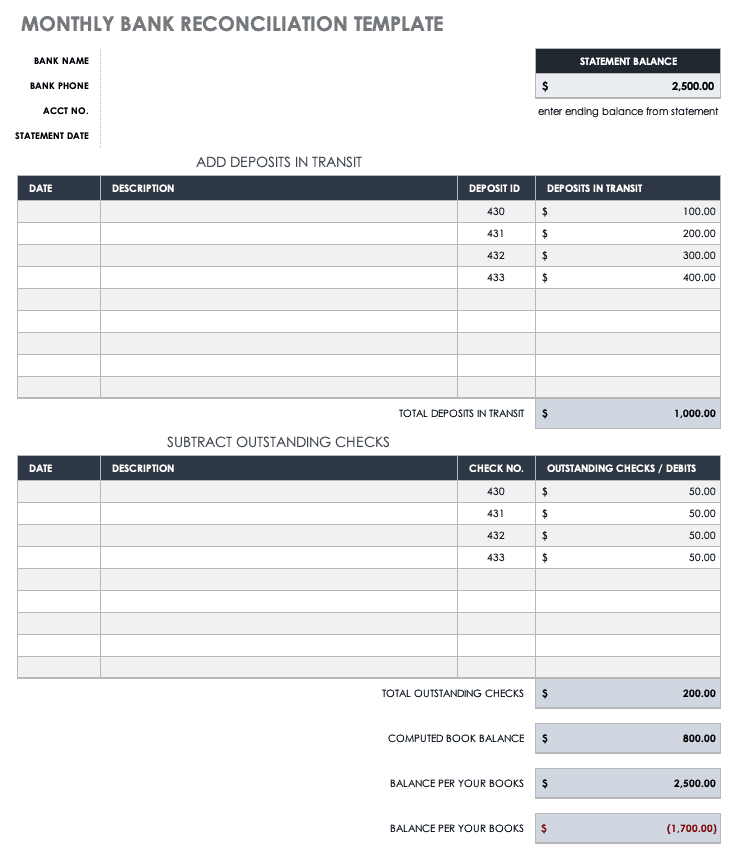

Monthly Bank Reconciliation Template

This simple bank reconciliation template is designed for personal or business use, and you can download it as an Excel file or Google Sheets template. Enter your financial details, and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting journal are reconciled. To create an ongoing record, copy and paste the blank template into a new tab for each month of the year.

Download Monthly Bank Reconciliation Template

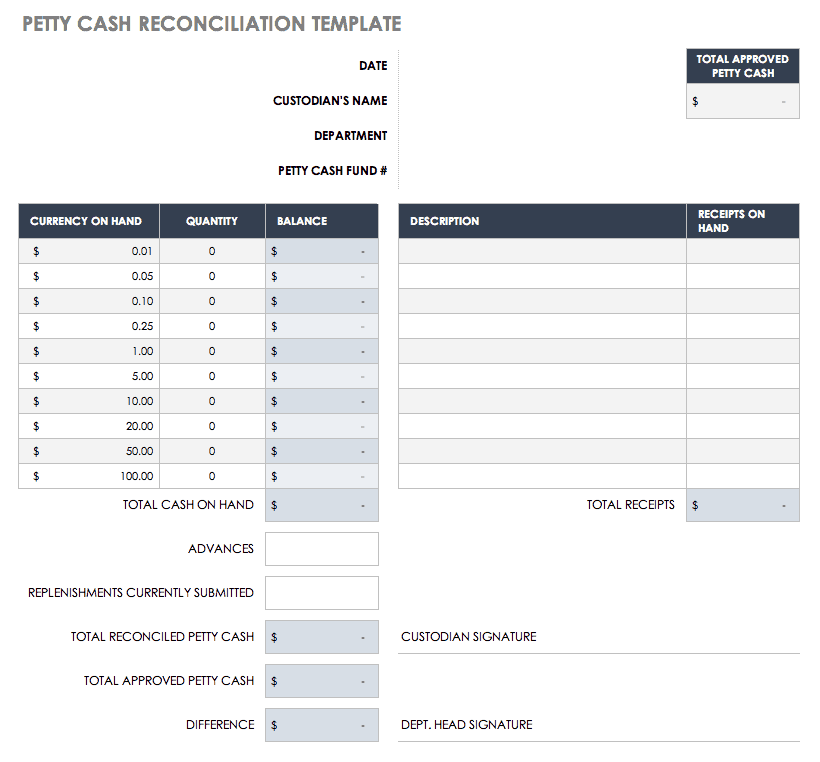

Petty Cash Reconciliation Template

Many businesses use petty cash funds to pay for minor expenditures. You can use this template for reconciling petty cash accounts to help ensure that you’ve accounted for current receipts and that cash amounts are accurate. How often you need to reconcile the account may depend on how frequently it is used.

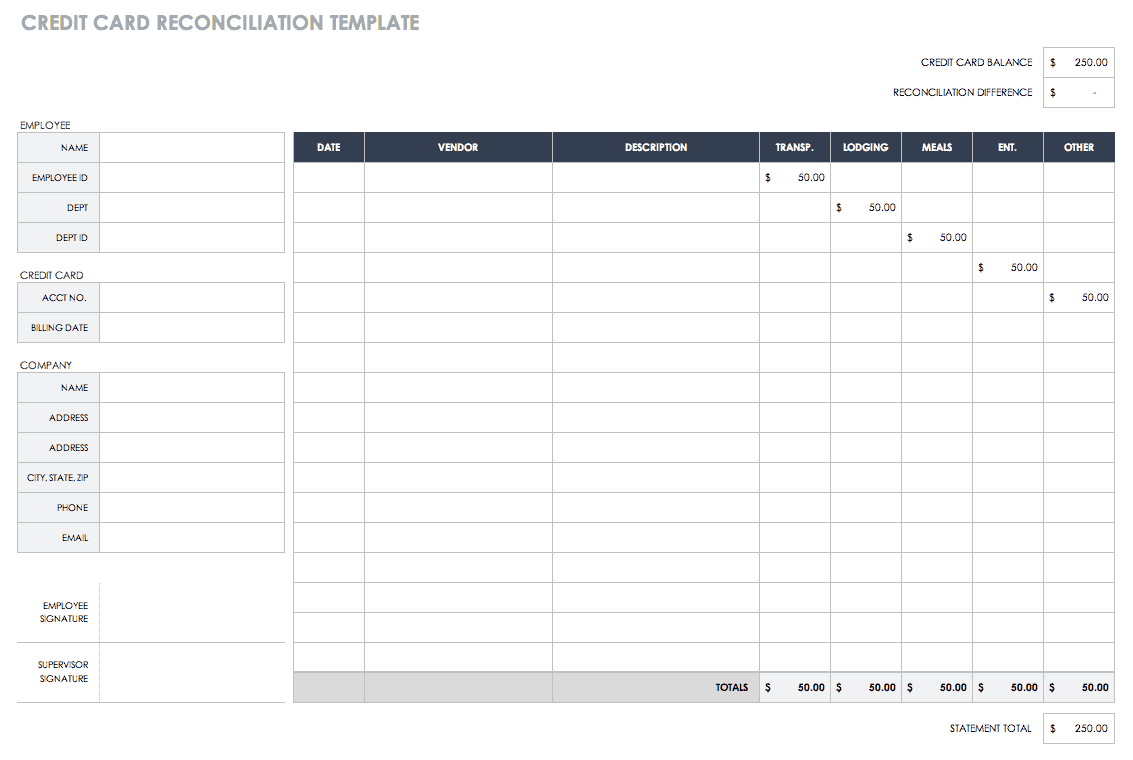

Credit Card Reconciliation Template

Reconcile a business credit card account with transaction receipts, and create an expense report for documentation. Edit the template to include business expenses that need to be tracked. Then, enter each charge amount along with dates and account numbers. This template can be used for travel, entertaining clients, or other authorized business expenses. Make sure that your credit card statement matches the transactions reported on the reconciliation template.

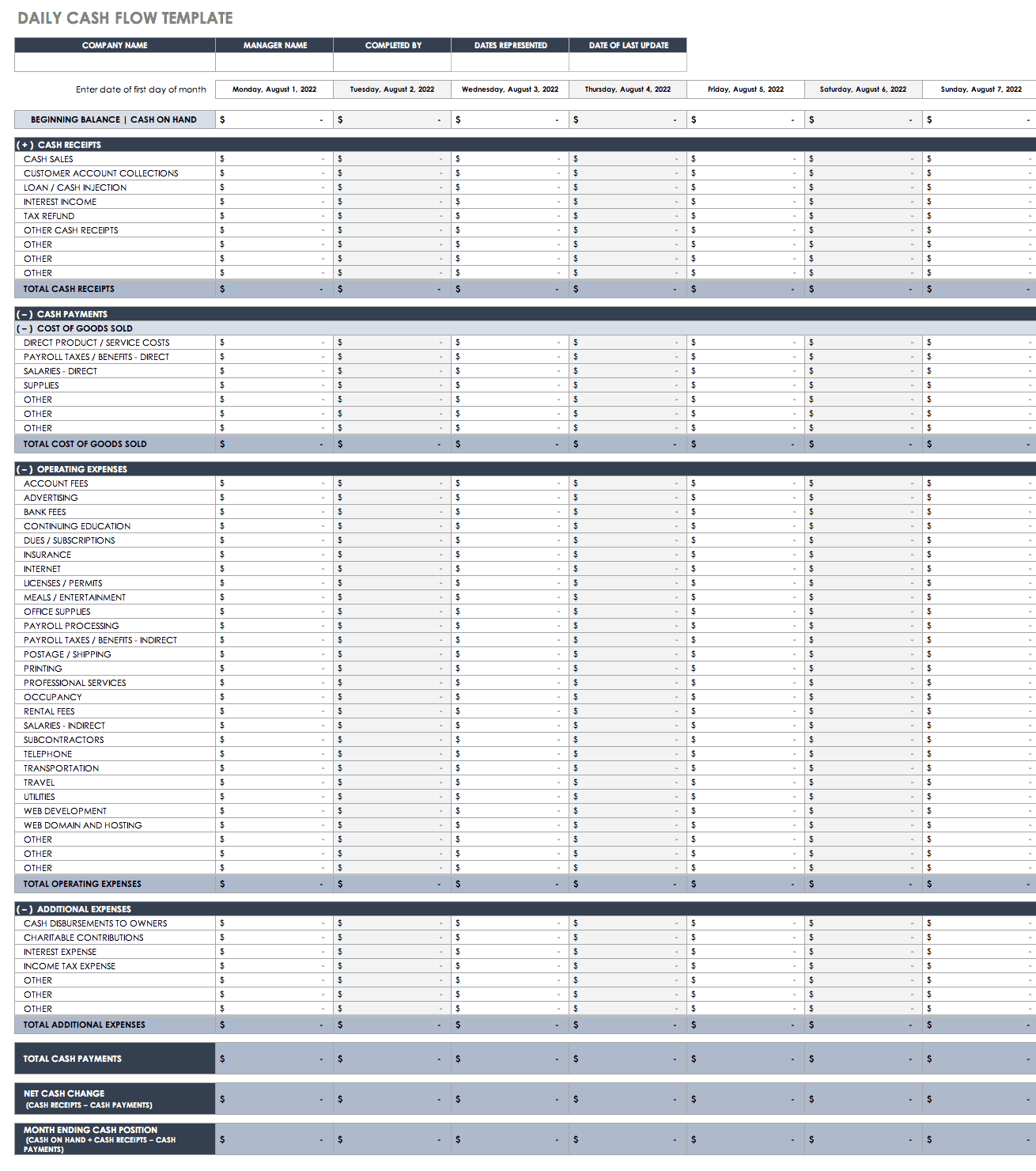

Daily Cash Flow Template

This comprehensive cash flow template allows you to view a breakdown of total receipts, payments, and expenses on a daily basis. Enter the first day of the month, and the template will fill in subsequent dates, providing a detailed look at daily cash flow. The template also shows the ending cash position so that you can quickly see if it reconciles with your balance sheet.

What Is Balance Sheet Reconciliation?

Balance sheet account reconciliation is the process of comparing a company’s general ledger, or primary accounting record, with subsidiary ledgers or bank statements in order to identify and resolve discrepancies. Since you can perform this process with internal subledgers for specific balance sheet accounts or external bank statements, the process is also known as bank reconciliation. This is an important part of monthly accounting in order to ensure accurate records, prepare for internal audits, detect fraud quickly, and manage cash flow. Individuals can also reconcile monthly bank statements with personal records to make sure they know their actual bank account balance and avoid overdrafts.

What Is Reconciliation in Accounts Payable?

Reconciling an accounts payable (AP) account involves matching the general ledger balance with the AP subsidiary ledger (or other record showing AP transactions). If the two ledgers match up, the accounts are reconciled. If not, the two ledgers need to be compared closely to identify errors such as missing or incorrect entries.

This process is typically performed monthly for efficiency and to prevent errors from carrying over from one month or year to the next. Accounts payable reconciliation may be done manually or with software, depending on the size of your business and accounting needs.

What Is the Accounting Reconciliation Process?

Documentation is important for all aspects of accounting, and organizations typically have reconciliation policies that must be followed, including due dates for submitting completed reconciliations. Here are the basic steps involved and the items to track as you reconcile accounts:

- Gather and Compare Records: Depending on the accounts you plan to reconcile, inspect and compare bank statements or subsidiary ledgers to a general ledger or personal accounting records. You may need to collect more than one financial report or records of deposits and checks in order to get a complete view of transactions. When comparing a bank statement to an accounting journal, take into account service charges, interest, and other fees. Outstanding checks or deposits won’t appear on the bank statement, so your comparison also needs to consider these factors.

- Identify Discrepancies: Once you have adjusted your ledger for outstanding transactions as well as fees and other charges, the two records should reconcile. If they don’t, look for any discrepancies between the bank statement and general ledger, which may occur due to bank errors or internal errors on the part of a company or individual.

- Resolve Discrepancies: Investigate any unusual or missing transactions to find the source of the issue and make corrections. Contact the bank about errors that they appear to be responsible for, and keep an eye out for errors that you or an employee may have made.

Reconciling accounts on a regular basis can help to maintain an efficient process, reduce errors in the long run, and limit the stress of dealing with financial discrepancies.

Improve Account Reconciliation with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.